Not all Financial Advisors are held to the same standards

The way your financial advisor is compensated can influence the recommendations they make, and some are more costly to you. There are essentially three models:

- Commission-based model

- Fee-based model

- Fee-only model

Both commissioned and fee-based (fee plus commission) receive compensation based on the specific financial products they sell you and may even be incentivized to prioritize their firm’s own products before others that have the same objective but carry a higher commission, and ultimately more costly to the client. Because of the inherent conflict of interest in these transactions, these advisors may have difficulty putting the client’s interest above their own.

A fee-only, fiduciary final advisor model legally requires a financial advisor to always act in their clients’ best interests. We believe clients deserve to work with someone who always puts their interests first. We do not earn commissions from selling securities or investment products.

The minimum requirements for a fiduciary financial advisor

Fiduciary Financial Advisors should at the very minimum:

- Ask great questions and listen well.

- Provide comprehensive financial planning that goes beyond investments.

- Proactively keep in touch with you.

- Suggest creative alternatives that you may not have considered, like the optimal way to claim Social Security.

- Know strategies to help you reach your goals, particularly the latest laws and tax code changes.

- Review your tax returns and look for possible future savings.

- Empathize with your fears and worries.

- Help define your short-term and long-term goals.

- Help to establish financial priorities when you have competing needs.

- Provide a roadmap on how to achieve your goals.

- Collaborate with you and other professionals, like attorneys and CPAs.

- Not have any history of regulatory violations, arbitrations, or complaints.

A Fee-only, Fiduciary Financial Advisor is the most transparent and objective way to serve clients. They are:

- Held to the highest standard of duty and loyalty.

- Put your interests before their own and act as a fiduciary all the time.

- Minimize bias by not accepting any incentives or commissions.

- Transparent on the fees they charge, which most clients admit they don’t know, as well as how they are compensated.

What distinguishes financial advisors from one another

What truly separates fee-only, fiduciary financial advisors is the breadth of work that spans beyond just investments. At Grand Life Financial, we provide comprehensive financial planning, which as you can see in the below visual, with your goals and values always considered when developing strategies and making recommendations.

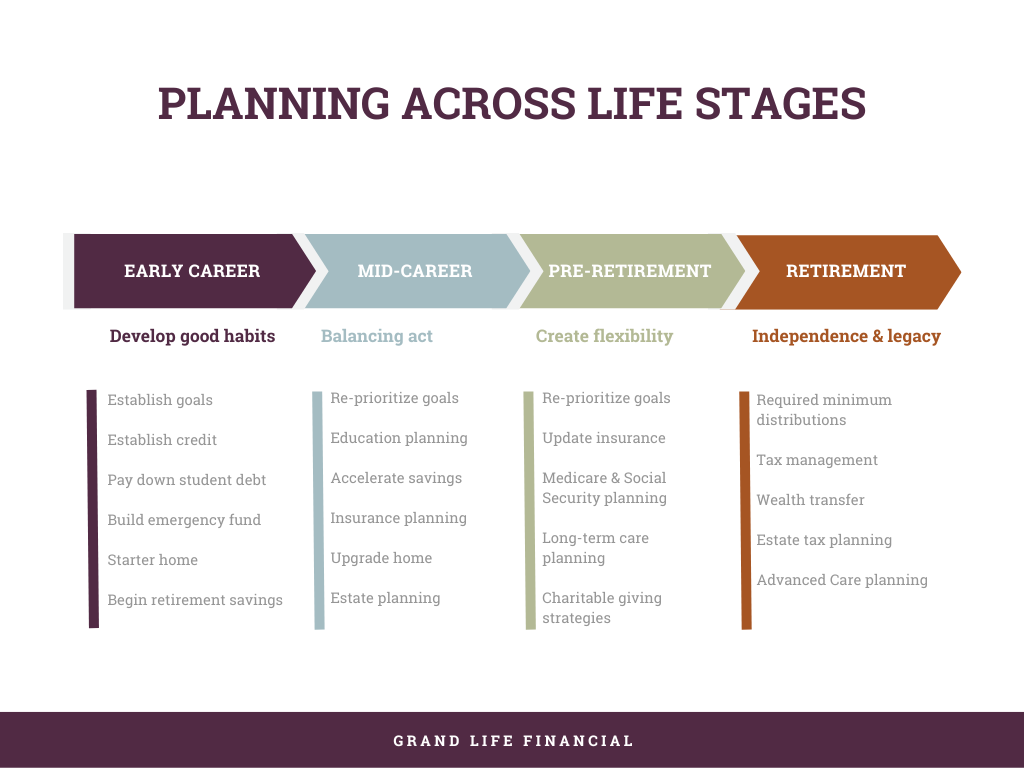

Fiduciary Financial Advisors support your life stages

Financial planning is something that supports you across various life stages, not just when you are changing jobs or preparing to retire. The below graphic illustrates just some of the areas that are covered during each stage.

Most people lack the discipline in following through on one-time advice, therefore financial planning is often found to be most successful when done as an ongoing engagement. This not only helps to ensure that the client is held accountable, but also that things are completed.

Lastly, financial planning can help protect your family from the unexpected events and reduce fear, such as:

- Market downturns

- Emergency expenses

- Long-term care costs

- Outliving your retirement income